south san francisco sales tax rate 2020

California City and County Sales and Use Tax Rates Rates Effective 01012020 through 03312020 Note. The latest sales tax rate for Presidio San Francisco CA.

Sales Tax By State Is Saas Taxable Taxjar

Some cities and local governments in San Francisco County collect additional local sales taxes which can be as high as 3625.

. Over the past year there have been 58 local sales tax rate changes in California. What is the sales tax rate in South San Francisco California. 1788 rows California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated.

Tax returns are required monthly for all hotels and motels operating in the city. Download all California sales tax rates by zip code. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax.

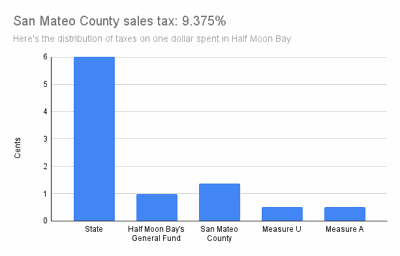

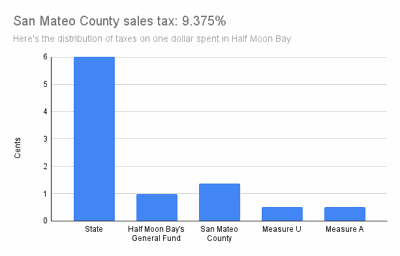

Raised from 925 to 9375 San Francisco. Depending on the zipcode the sales tax rate of south san francisco may vary from 65 to 975. The current Transient Occupancy Tax rate is 14.

The County sales tax rate is 025. You can print a 9875 sales tax table here. The minimum combined 2021 sales tax rate for south san francisco california is.

Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. Finally measure ff would increase the citys tot rate to a maximum of 14 effective january 1 2021.

Percent for the nation during the same period. Interactive Tax Map Unlimited Use. Amboy 7750 San Bernardino City Rate County American Canyon 7750.

New Local Charge Rate for San Francisco Retail Sales of Prepaid Mobile Telephony Services MTS Effective April 1 2020 New Sales and Use Tax Rates Operative April 1 2020 January. SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes. City of San Mateo 9625 City of South San Francisco 9875 SANTA BARBARA COUNTY 775 City of Carpinteria 900 City of Guadalupe 875.

South san francisco ca sales tax rate. San Mateo Co Local Tax Sl. The current total local sales tax rate in San Francisco CA is 8625.

The south san francisco california general sales tax rate is 6. The current Conference Center Tax is 250 per room night. South San Francisco Sales Tax Calculator For 2021 San Francisco saw more than half a billion dollars in hotel sales transactions last year a 200 increase over the year before despite three fewer deals in 2021.

2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for South San Francisco California is 988. The transfer tax rate for the city and county of san francisco payable upon transfer of real property is calculated as follows.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. South san francisco lies north of san bruno and san francisco international airport in the colma creek valley south of daly city. With local taxes the total sales tax rate is between 7250 and 10750.

The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. Boost your business with wix. This rate includes any state county city and local sales taxes.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. Anaheim 7750 Orange Anderson 7750. Sales taxes 26958595 149 28606235 26313958 1647640 -58 Property transfer taxes 9137370 50 13918129 11778074 4780759 -343 Business hotel other taxes 11173135 62 14947968 14777396 3774833 -253.

The December 2020 total local sales tax. South San Francisco Resident Survey Shows Residents Feel City is Moving in Right Direction. Collection Procedures for Transient.

The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. The South San Francisco sales tax rate is 05. The California sales tax rate is currently 6.

This is the total of state county and city sales tax rates. Ad Lookup Sales Tax Rates For Free. Look up the current sales and use tax rate by address.

California has recent rate changes Thu Jul 01 2021. The San Francisco County Sales Tax is 025. The state sales tax rate in California is 7250.

The current total local sales tax rate in South San Francisco CA is 9875. The December 2020 total local sales tax rate was 9750. San Francisco CA Sales Tax Rate.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. There is no applicable city tax. The County sales tax rate is 025.

Select the California city from the list of cities starting with A below to see its current sales tax rate. The minimum sales tax in California is 725. San francisco kron several cities will have a sales use tax hike.

Update to postal code abbreviation table effective may 2020 filing period. The san francisco sales tax rate is 0. For tax rates in other cities see.

South san francisco sales tax rate 2020. South San Francisco CA Sales Tax Rate. Next to city indicates incorporated city City Rate County Acampo.

This is the total of state county and city sales tax rates.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

States With Highest And Lowest Sales Tax Rates

Prop K Sales Tax For Transportation And Homelessness Spur

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

Salesforce Announces Strong Third Quarter Fiscal 2021 Results Salesforce News

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Sales Tax On Saas A Checklist State By State Guide For Startups

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Frequently Asked Questions City Of Redwood City

California Sales Tax Rates By City County 2022

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

What Are California S Income Tax Brackets Rjs Law Tax Attorney